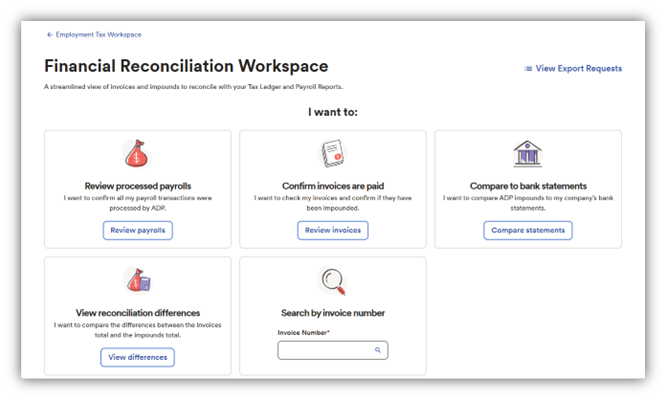

We’ve made it even easier for you to view and verify reconciled payroll transmissions by adding a new payroll tile to the Financial Reconciliation Workspace called Review Processed Payrolls.

With an intuitive layout that takes the guess work out of funding reconciliation tasks, this update provides detailed visibility into all your payroll transmissions and invoices – saving you a lot of time!

Log in to SmartCompliance, then Employment Tax > Tax Filing >Financial Reconciliation - Select Review Payrolls

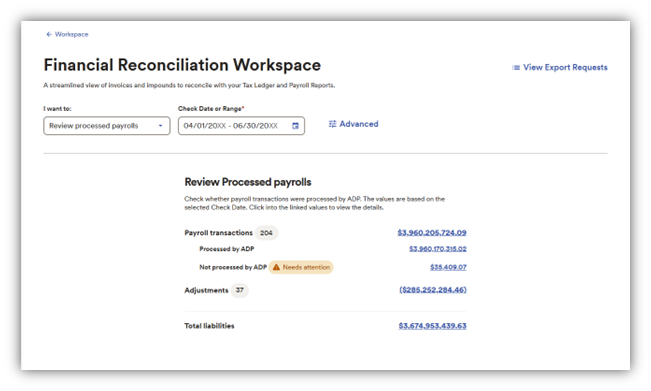

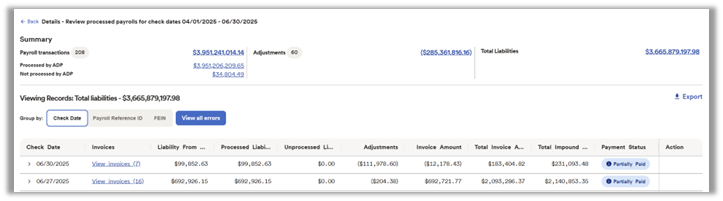

As you can see below, the workspace offers a simplified filter to identify transactions “Processed by ADP and transactions “Not processed by ADP” (as seen below)

Next, customize your data view by selecting the available tab options

Group by:

Check Date, Payroll Reference Id, or FEIN (as seen below)

Want to learn more? Check out this video guide in SmartCompliance on how to maximize the Financial Reconciliation Workspace. Simply go to Help > myLearning@ADP > Content Library > ADP SmartCompliance: Financial Reconciliation

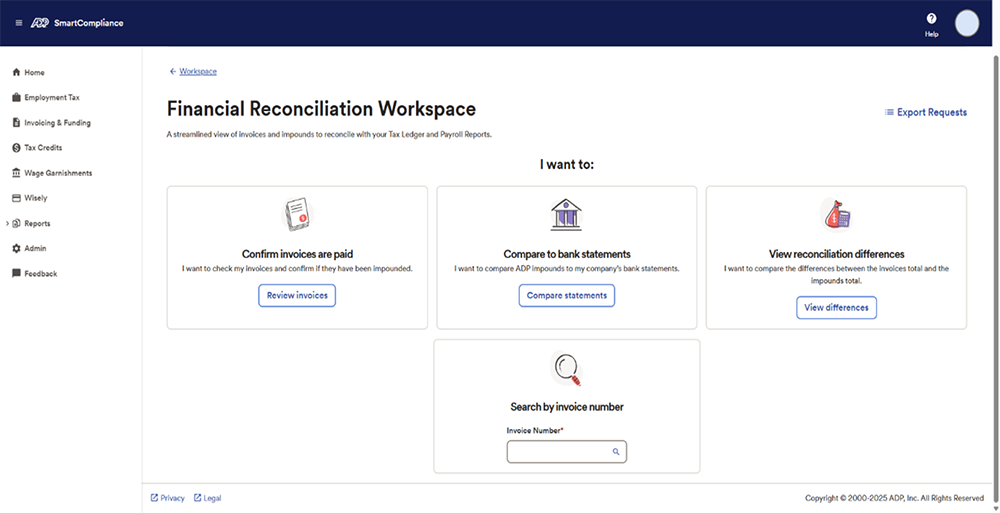

Do you ever need to take care of tasks like comparing invoices to bank statements or separating payroll transmissions versus adjustment transactions? Then you’ll love the new ADP SmartCompliance® Financial Reconciliation Workspace, which provides detailed visibility into all your payment transmissions and invoices.

With an intuitive layout that’s easy on the eye, the Workspace is a great timesaver for managing quarterly/year-end compliance requirements or your everyday needs (see image below).

Simply log in to SmartCompliance; then select Employment Tax > Tax Filing > Financial Reconciliation.

As you’ll see, the Workspace neatly displays several financial reconciliation action tiles, with each providing the required fields for you to easily complete tasks in no time.

UPDATE: This feature is currently back in the lab for fine-tuning. We hope to release a new, improved version soon and will let you know when it’s up and running.

We’ve created an FAQ database to help provide answers to your employment tax-related questions and save you time waiting on Service Request responses.

Simply Log in to ADP SmartCompliance, go to Help, then TAX FAQ. From there, just type your question into search field.

We already have more than 150 of these questions stored, so please let us know if you can’t find an answer you’re looking for by using the Feedback button in SmartCompliance.

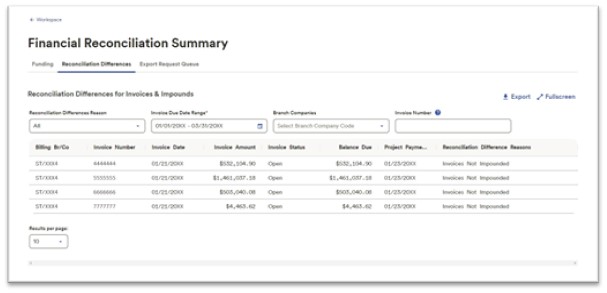

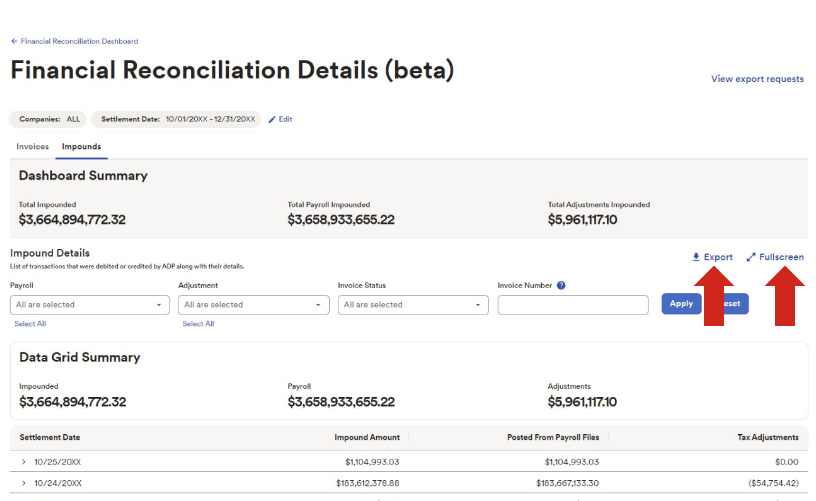

The new Reconciliation Differences tab highlights the differences between the Invoices total and the Impounds total when viewing the Funding tab and filtering by Invoice Due Date or Check Date. This saves you a lot of time having to switch between tabs and improves data accuracy.

After logging in to ADP SmartCompliance®, go to Employment Tax Filing; then select the Financial Reconciliation Summary tab (as seen in screenshot below). Click Reconciliation Differences; then you’ll see a drop-down menu with the following definitions to choose:

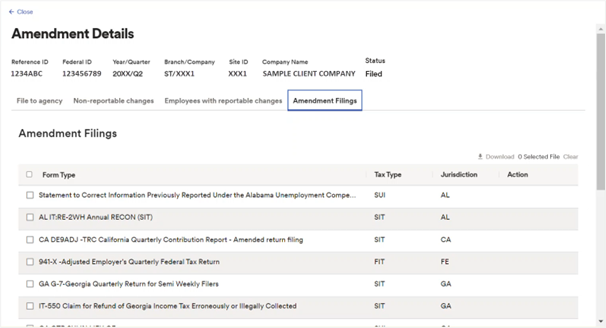

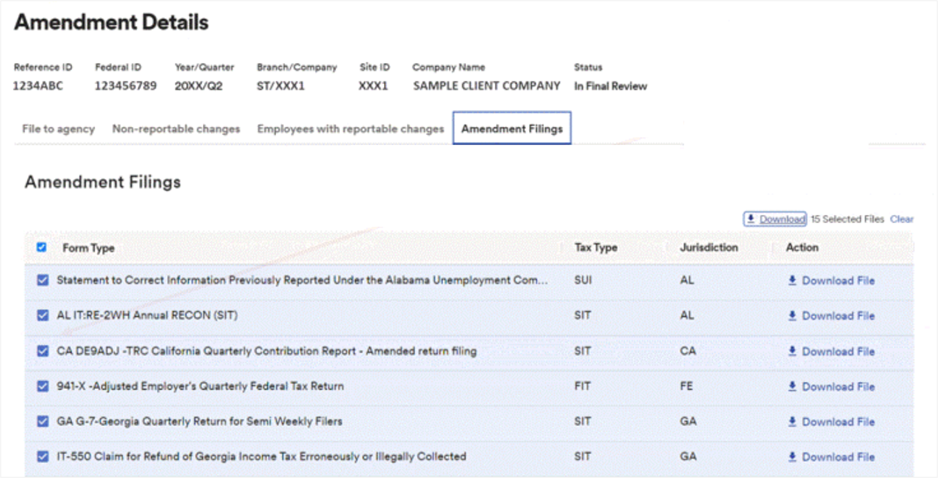

You no longer need to wait up to 30 days before accessing copies of amended tax returns. We’ve updated ADP SmartCompliance® so that copies of returns post in real time as they’re filed with respective agencies, meaning you have the information you need when you need it.

Before, all amended tax return copies were packaged into the same file, which became available for download only after every amendment was filed with its respective agency. And that process could take between 5-30 days before access was available.

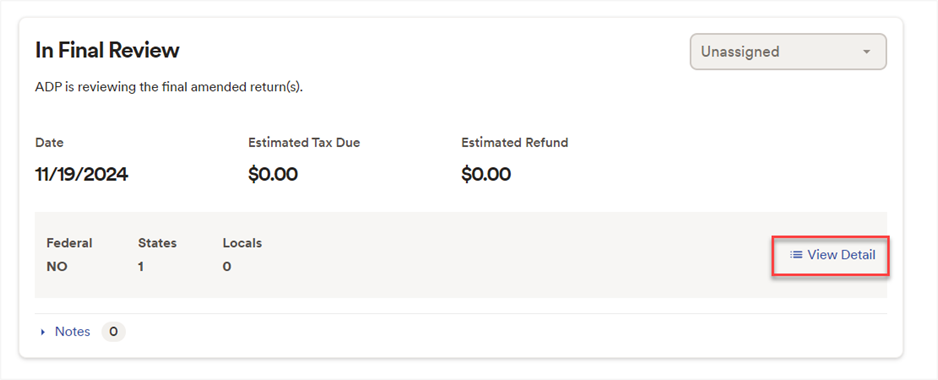

Now, whenever an amended tax return is filed with the agency, you can simply download a copy of it (as seen in image below).

How to Access Amendments by Jurisdiction: From the Processes tab, click Amendment Control with status of Final Review or Filed; then click View Detail (as seen below). Select the Amendment Filings tab (as seen below); and jurisdictions will post as they become available. NOTE: Once all jurisdictions are available, the status will change to Filed.

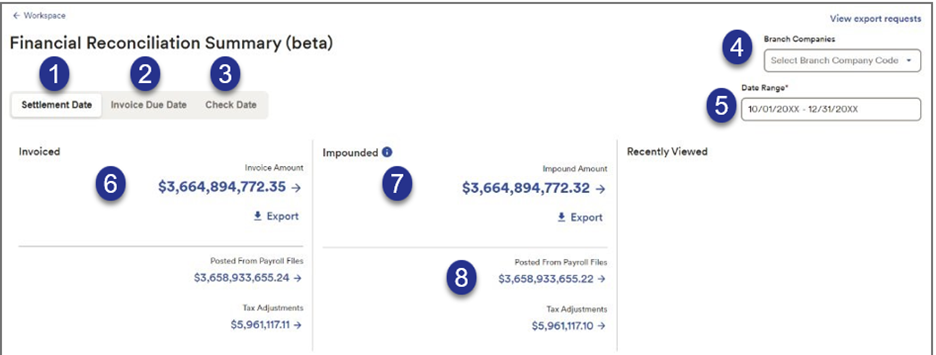

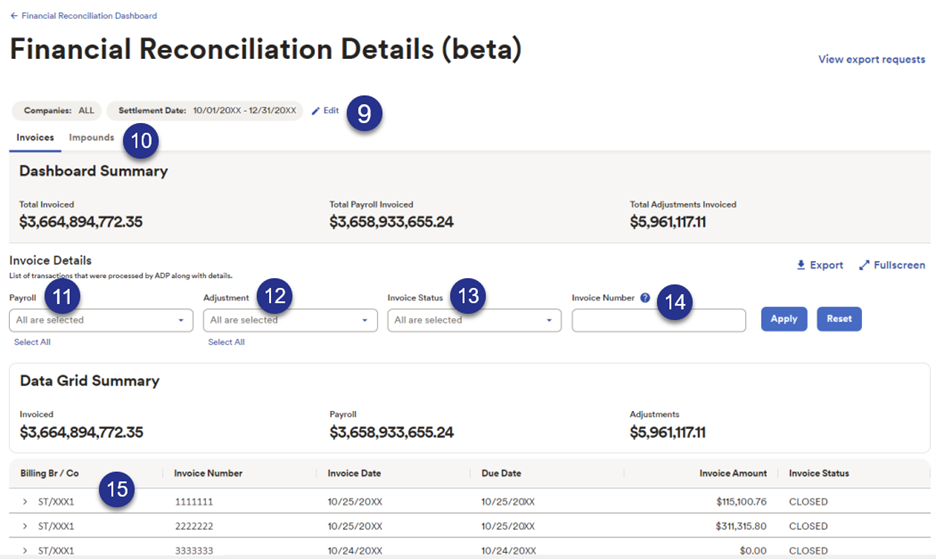

Ever need to tie ADP impounds to your bank statement? Or figure out which invoices made up the impound? Or how about trying to understand payroll versus transaction adjustments? The ADP SmartCompliance® Funding Reconciliation tool takes care of it all, with easy access and detailed visibility into all your payment transmissions and invoices.

Follow these simple steps: log in to ADP SmartCompliance, then Employment Tax > Tax Filing > Financial Reconciliation

Once opened, the Reconciliation Tool offers plenty of options to locate key invoice details, such as the Settlement Date (as seen below).

You can also search by Payroll Comment Code, Invoice Comment Code, or Invoice Status, Open or Closed, and even search for multiple invoices (as seen below).

Additionally, you can also export data or expand the screen size for enhanced functionality and visibility.

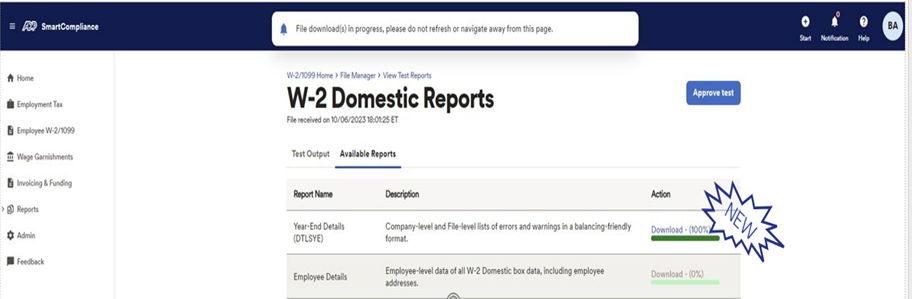

When you download employee W-2/1099 reports in ADP SmartCompliance®, you can now view the file status in real-time.

With download times taking no more 15 seconds for even the largest file, you won’t be wondering when a report will be ready or having to check back later – a real timesaver. Here’s how it looks:

When a report includes multiple company codes, we’ve also added messaging letting you know if a report is restricted for download due to company code access permissions.

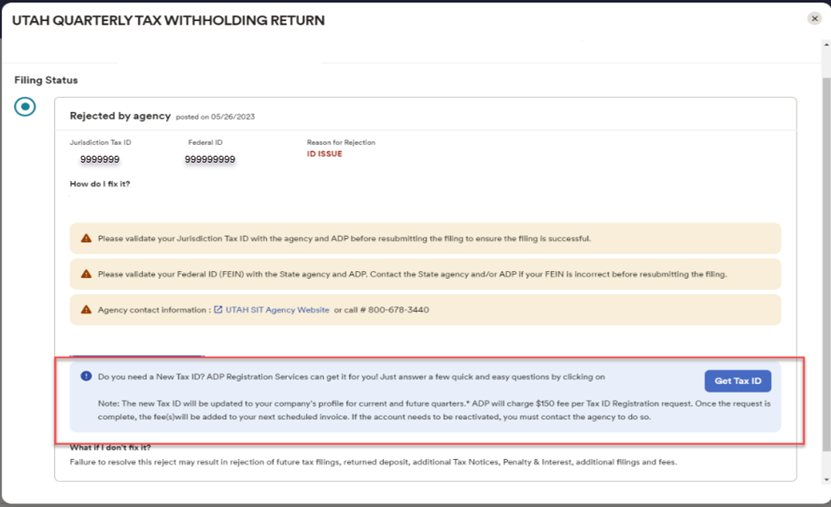

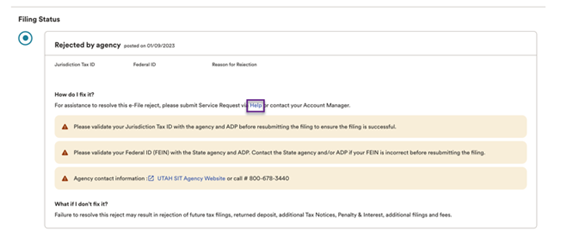

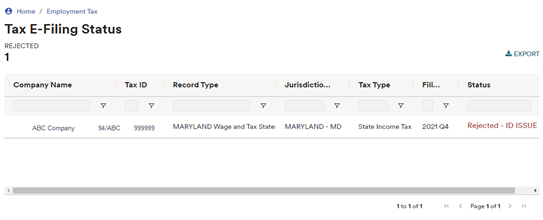

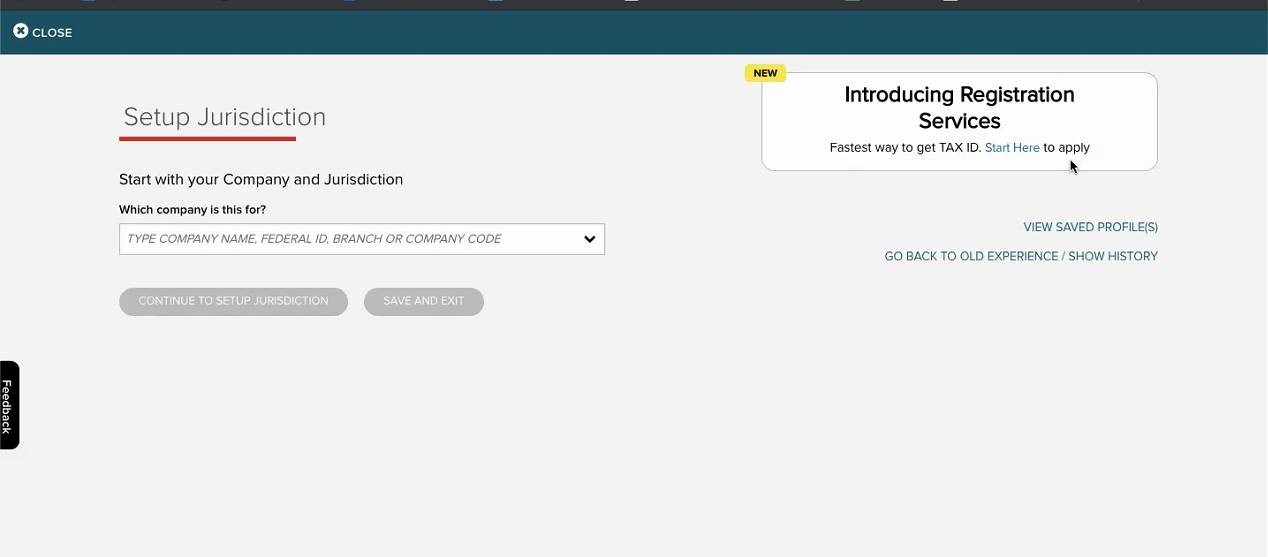

We’ve added it as an option to the Tax Filing Status page to better help you resolve e-flings that are rejected because of a Tax ID issue.

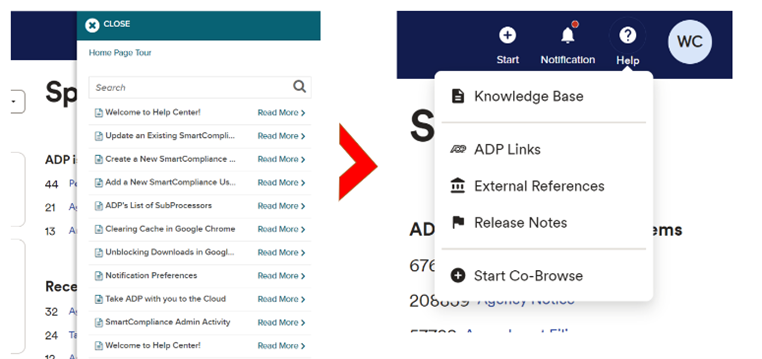

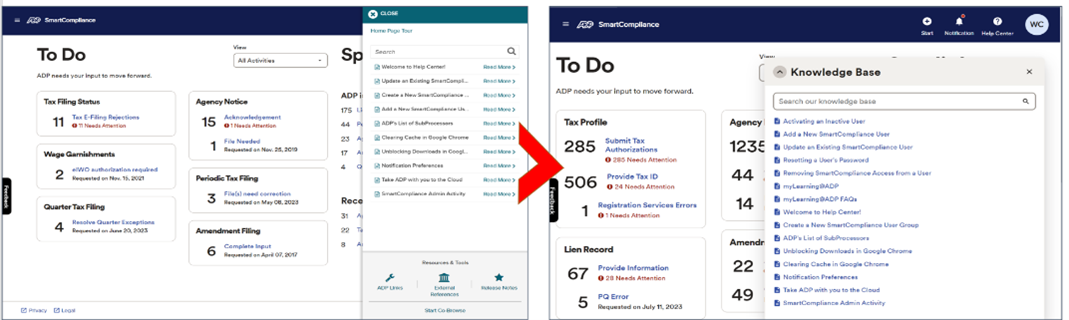

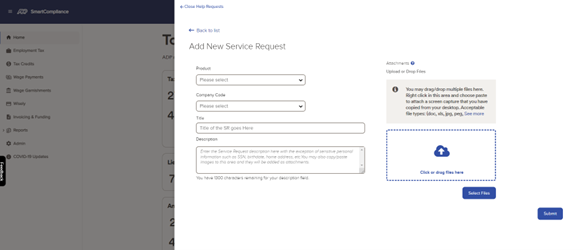

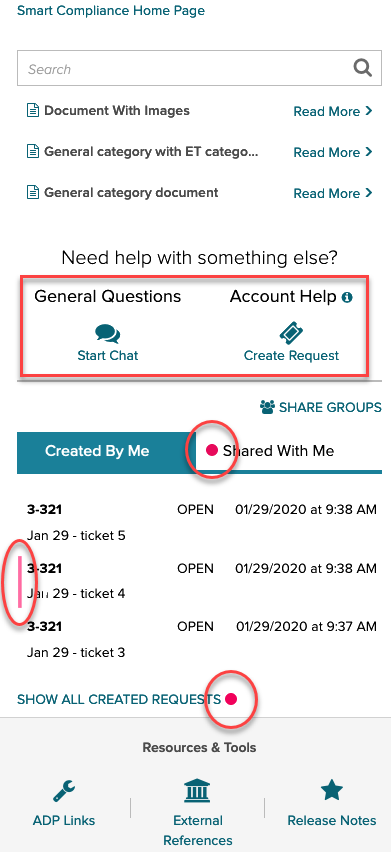

We’ve transformed the ADP SmartCompliance Help experience into a one-stop resource that makes managing your service requests (SRs) easier. From initiating, managing and viewing SRs in real time to learning about Smartcompliance, here’s what to look for in the new experience.

Effortless navigation: Instead of a panel displaying when clicking Help, a drop-down menu will open instead, neatly displaying all your options without character limitations (as seen below).

A wealth of knowledge: When clicking Knowledge Base from the menu, articles will now appear with 50 percent more viewing space (see image below). We’re also constantly updating this space with invaluable information to ensure you’re getting the most from your user experience, so it’s always worth checking in.

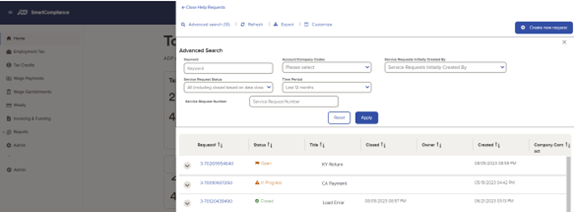

Real-Time Status Updates:Forget about your email inbox to see SR updates. As soon as there’s a change of status, we’ll update it in real time. And the new search option makes it easy to locate the information you’re looking for (see image below).

Exporting SR Details:We’ve added functionality that allows you to provide SR details to other associates.

New and Enhanced Functionality to Track Your SRs: Now, when you submit an SR, a new workspace appears (as seen below) that allows you to update multiple attachments of up to nine MGs in just about any format.

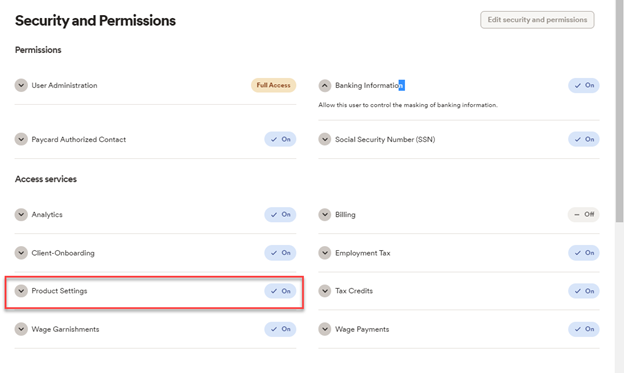

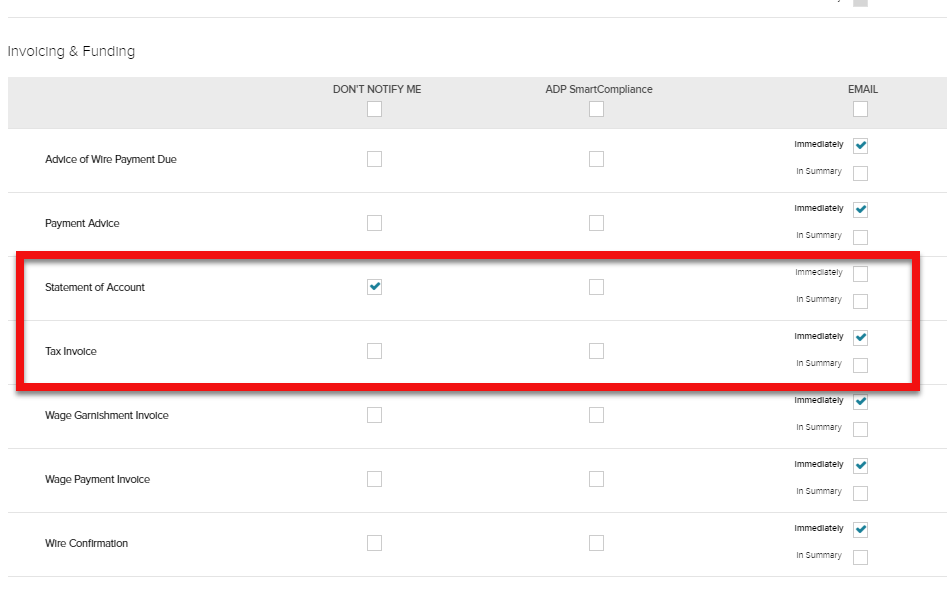

Managing Tax Liability Invoice email distribution addresses is now available to Admin Users with access to the Product Settings space (see image below). Here’s what you’ll see when you go to ADMIN > Product Settings:

This new feature will save you time while ensuring your sensitive data always stays securely within ADP SmartCompliance.

To grant Product Settings access to Admin Users: Start from the ADMIN space, select the admin user, scroll down to “Security and Permissions "and select Edit. Now you can change the “Product Settings” option to “On”.

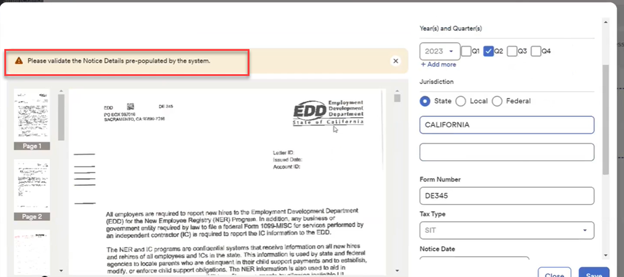

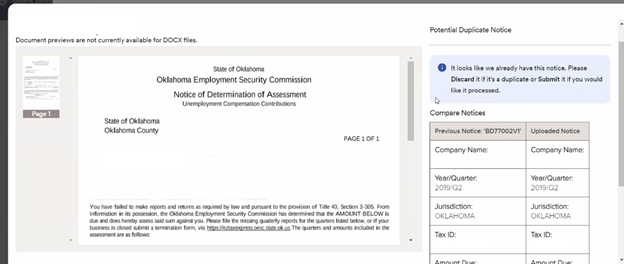

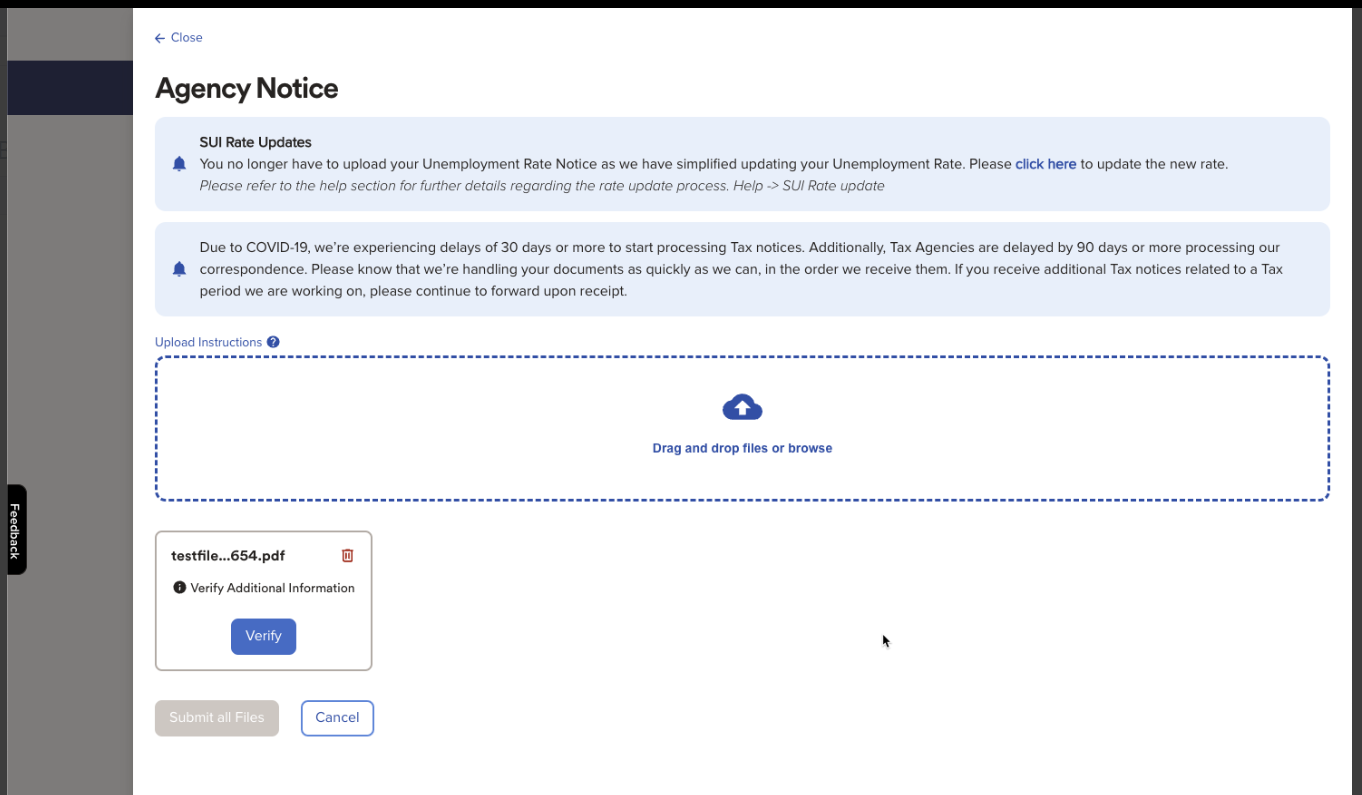

We’ve added a couple of timesaving enhancements to speed up the submission process of your tax notices while filtering out any potential duplicates.

System logic automatically extracts information from the notice after you upload it and, in a few moments, populates what’s needed into the submission form for you.

From there, just validate the pre-populated notice details and submit the notice for processing (see highlighted portion of screenshot example below).

If the notice is a potential duplicate or informational only, we’ll tell you in an instant. This saves time by not having to wait days for these types of responses from ADP (see highlighted portion of screenshot example below).

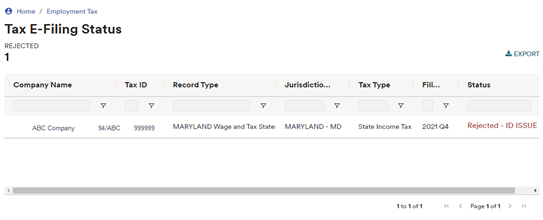

This great timesaver allows you to view, resolve, and resubmit rejected tax returns in one convenient place, so you’ll no longer need to wait on mailed hardcopies before taking action. Here’s how it works:

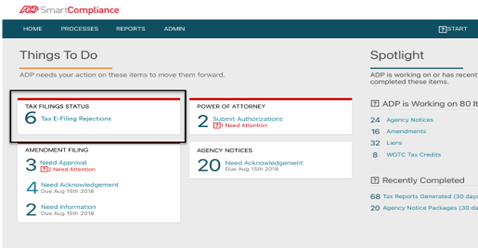

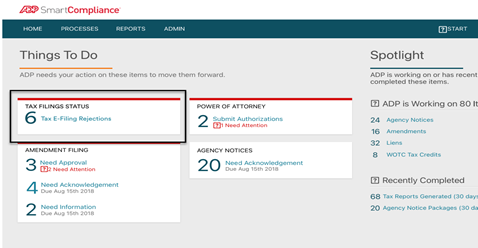

1. In SmartCompliance, simply go to Things to Do, where you’ll see the Tax Filing Status tile (see below).

2. After clicking Tax Filings Status, you’ll be able to see why your E-Filing was rejected. ADP SmartCompliance will display all rejected filings with the filing status.

3. Depending on the rejection reason, ADP will resubmit the filing on your behalf after you make the correction, or you can contact ADP by clicking the HELP link.

Note:

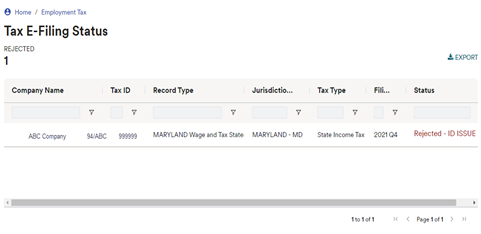

You can also view your E-filing status in the Employment Tax workspace: Go to Processing > Employment Tax > Tax E-Filing Status.

The enhancement displays accepted E-filings from 2Q22 E-filings onwards.

We’re continuing with changes to the look and feel of SmartCompliance, which is why you may notice a brighter appearance to the tax notice upload page (see example below). However, none of its easy-to-use functionality has changed.

As a reminder, for fastest uploading of notices; from the Start button in the upper right-hand side of the homepage, select Upload an Agency Notice, and follow the instructions and important notes.

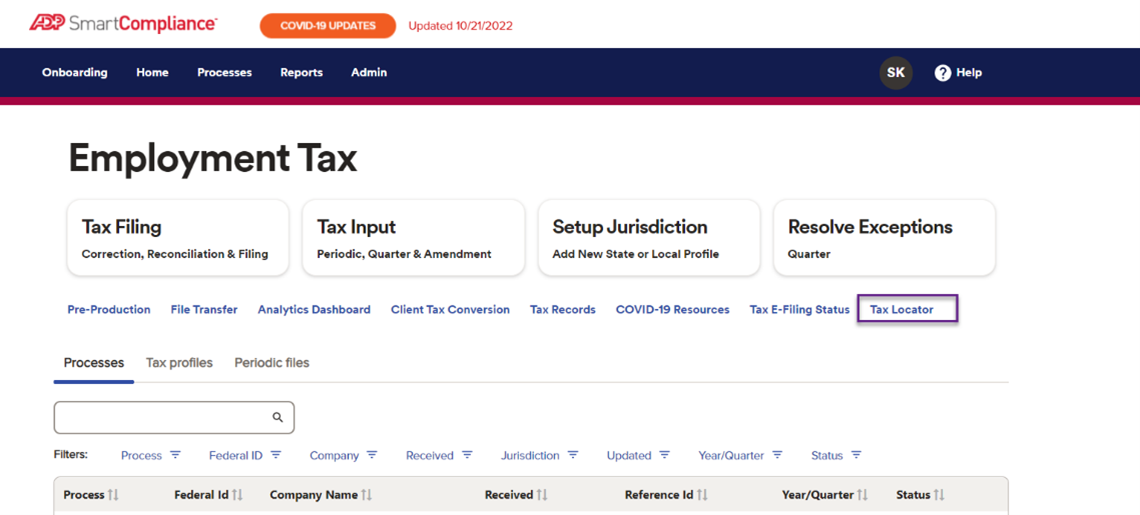

The Tax Locator feature has a new, easy-to-access home in SmartCompliance. Here’s how to find the feature, which allows you to find information required to set up state and local profiles: Go to Processes, Employment Tax, then Tax Locator (see screenshot below).

This great timesaver allows you to view, resolve, and resubmit rejected tax returns caused by ID Issue-Not Registered. Here’s how it works:

1. In SmartCompliance, simply go to Things to Do, where you’ll see the Tax Filing Status tile.

2. After clicking Tax Filings Status, select an item from the list of rejected filings and we will guide you through the actions to correct and resubmit the filing(s) to the agency.

This great timesaver allows you to view, resolve, and resubmit rejected tax returns in one convenient place, so you’ll no longer need to wait on mailed hardcopies before taking action. Here’s how it works

1. In SmartCompliance, simply go to Things to Do, where you’ll see the Tax Filing Status tile (see below).

2. After clicking Tax Filings Status, you’ll be able to see why your E-Filing was rejected. ADP SmartCompliance will display all rejected filings with the filing status.

3. Depending on the rejection reason, ADP will resubmit the filing on your behalf after you make the correction, or you can contact ADP by clicking I want ADP to Contact Me at the bottom of the page.

For data-sensitivity reasons, we’ve made the Statements of Account for wire funding clients and Tax Invoices available in SmartCompliance by selecting Processes >Invoicing & Funding..

Now, if you’d like a notification from SmartCompliance when statements or tax invoices are available, you can change your settings in Notification Preferences. Simply click the round icon with your initials in the top righthand corner of the screen, select Notification Preferences and update your selection in the Invoicing & Funding section.

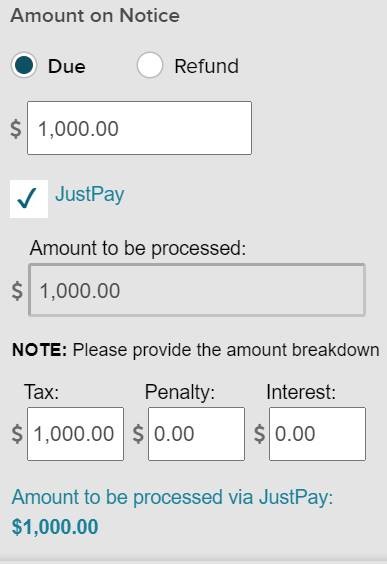

Paying a tax notice right away normally requires adding a comment in the Agency Notice workflow or sending a request to your ADP service representative. The "JustPay" option simplifies this process by paying it directly without contacting your service team.

How it Works: After completing the upload template for your tax notice, select the "JustPay" option, and we’ll expedite the amount due shown on the notice to the agency without researching it.

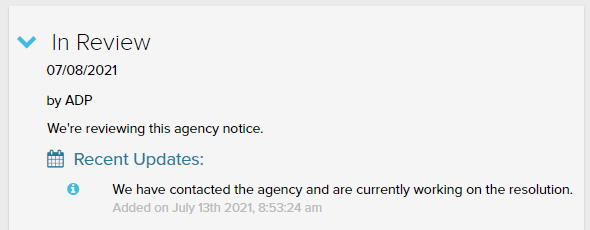

To stay up to date with our efforts resolving tax notices on your behalf, click the “In Review” tile within the Agency Notice Workflow for progress updates.

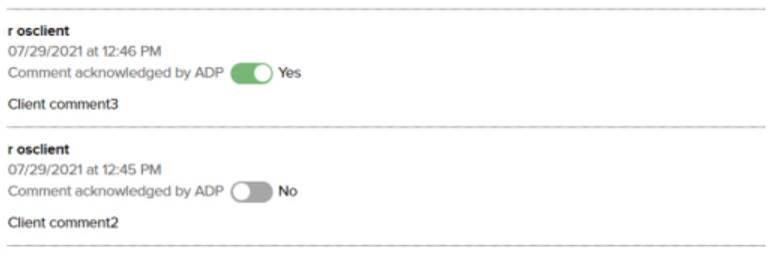

To improve transparency with ADP’s research of your agency notices, we will acknowledge notes provided to us via SmartCompliance. No more guessing if ADP researchers saw your notes; just navigate to the Agency Notice Workflow to see the acknowledgement on the "Notes to ADP Researcher" tile

If you wire tax liabilities to ADP, you can now access your Statement of Account in SmartCompliance. Simply navigate to Processes > Invoicing and Funding > Statements for statements going back to February 2021.

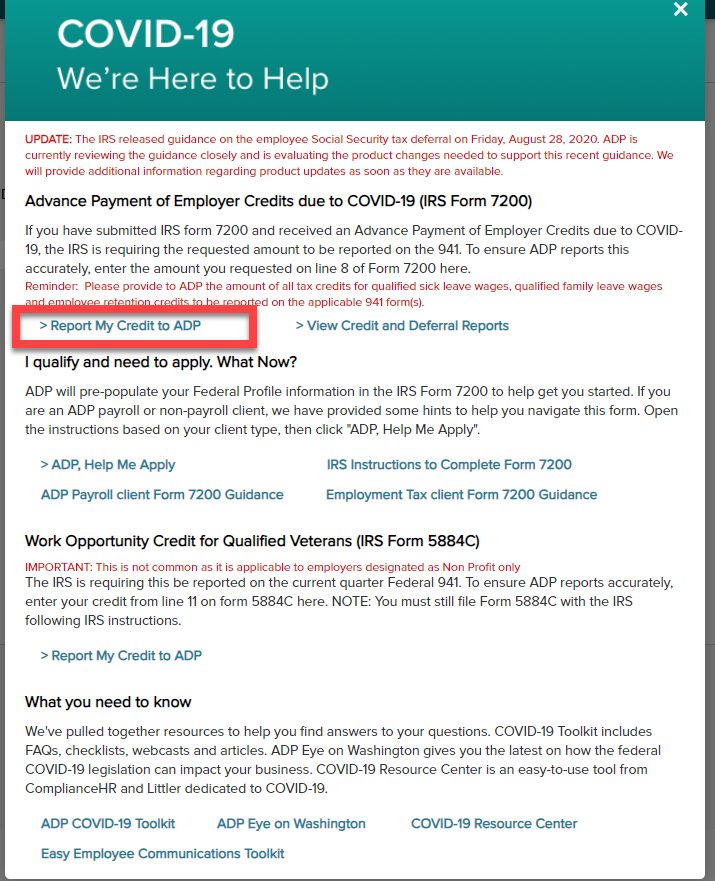

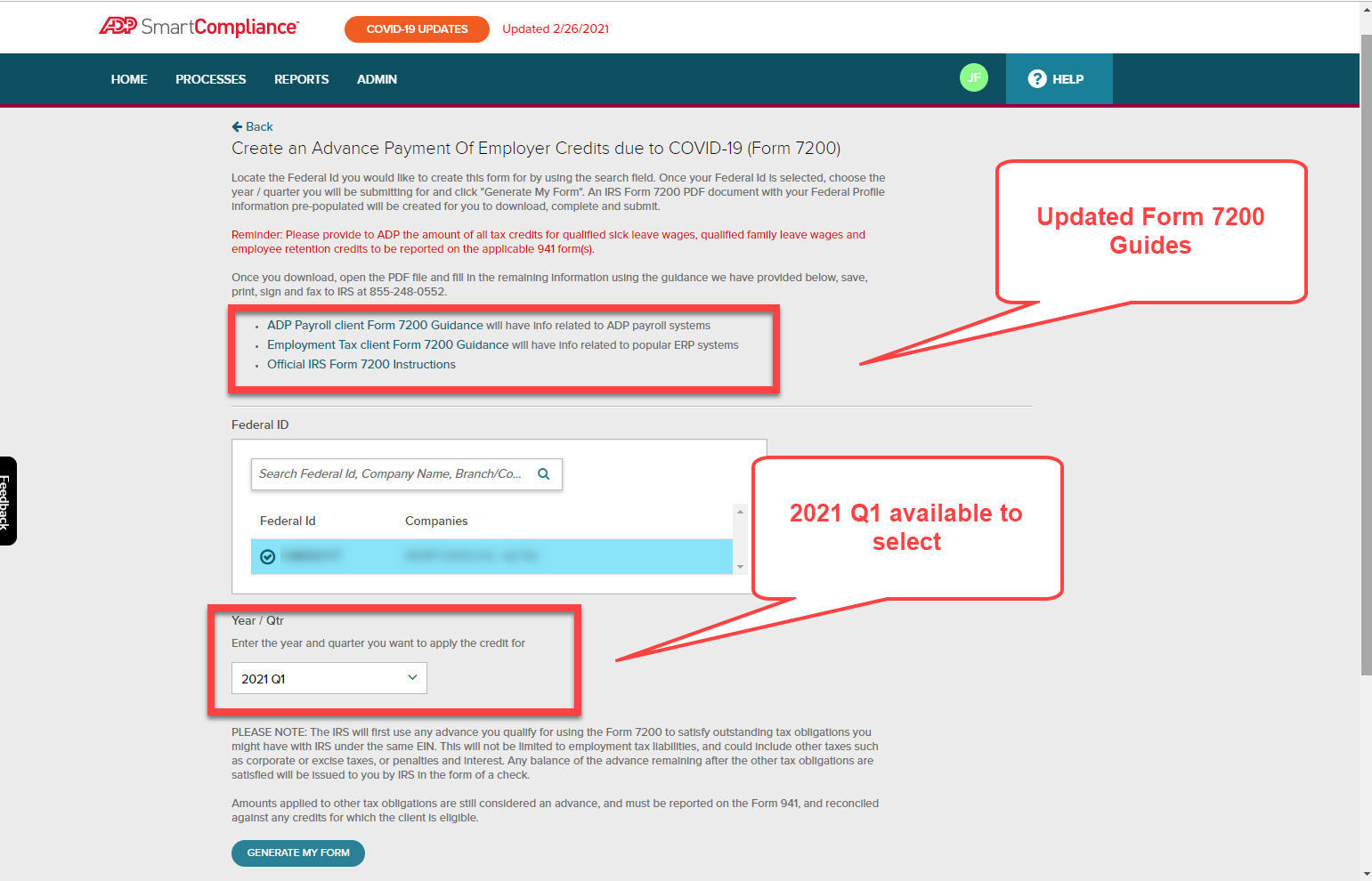

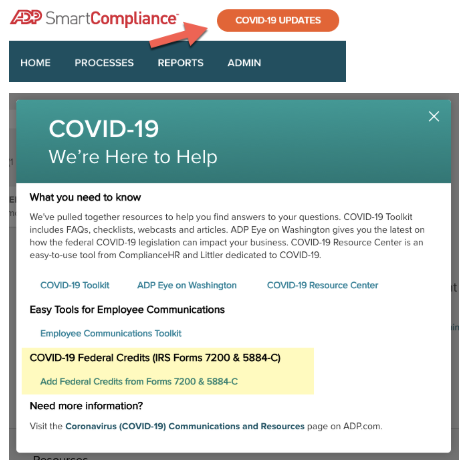

An updated Form 7200 is now available for second quarter 2021. Simply follow the COVID-19 UPDATES link at the top of any screen within SmartCompliance, click Report My Credit to ADP, and follow the instructions.

If you’ve completed Form 5884-D, we’ve made it easy for you to provide us with the related credit amounts you received. It’s easy to do; just click COVID-19 UPDATES, select Report my Credit to ADP and follow the prompts—we’ll use that data to file your quarterly 941.

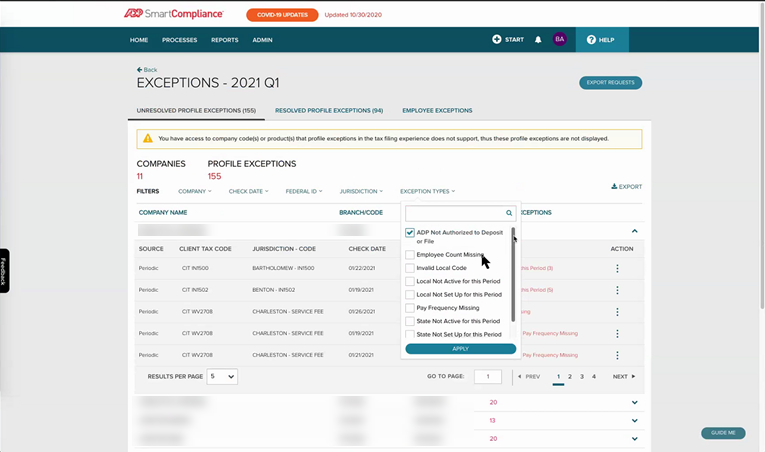

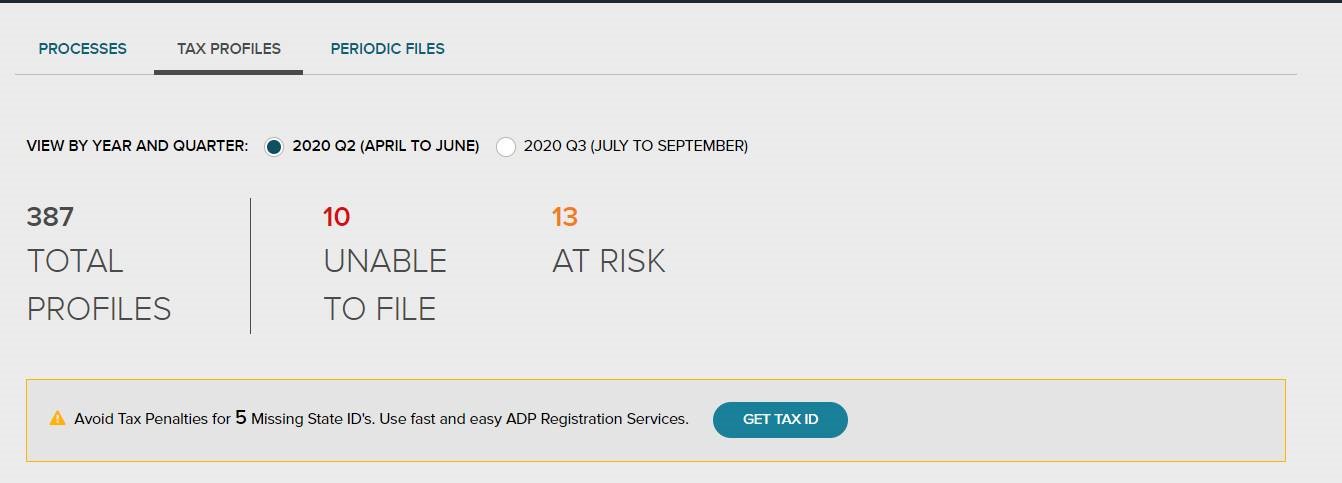

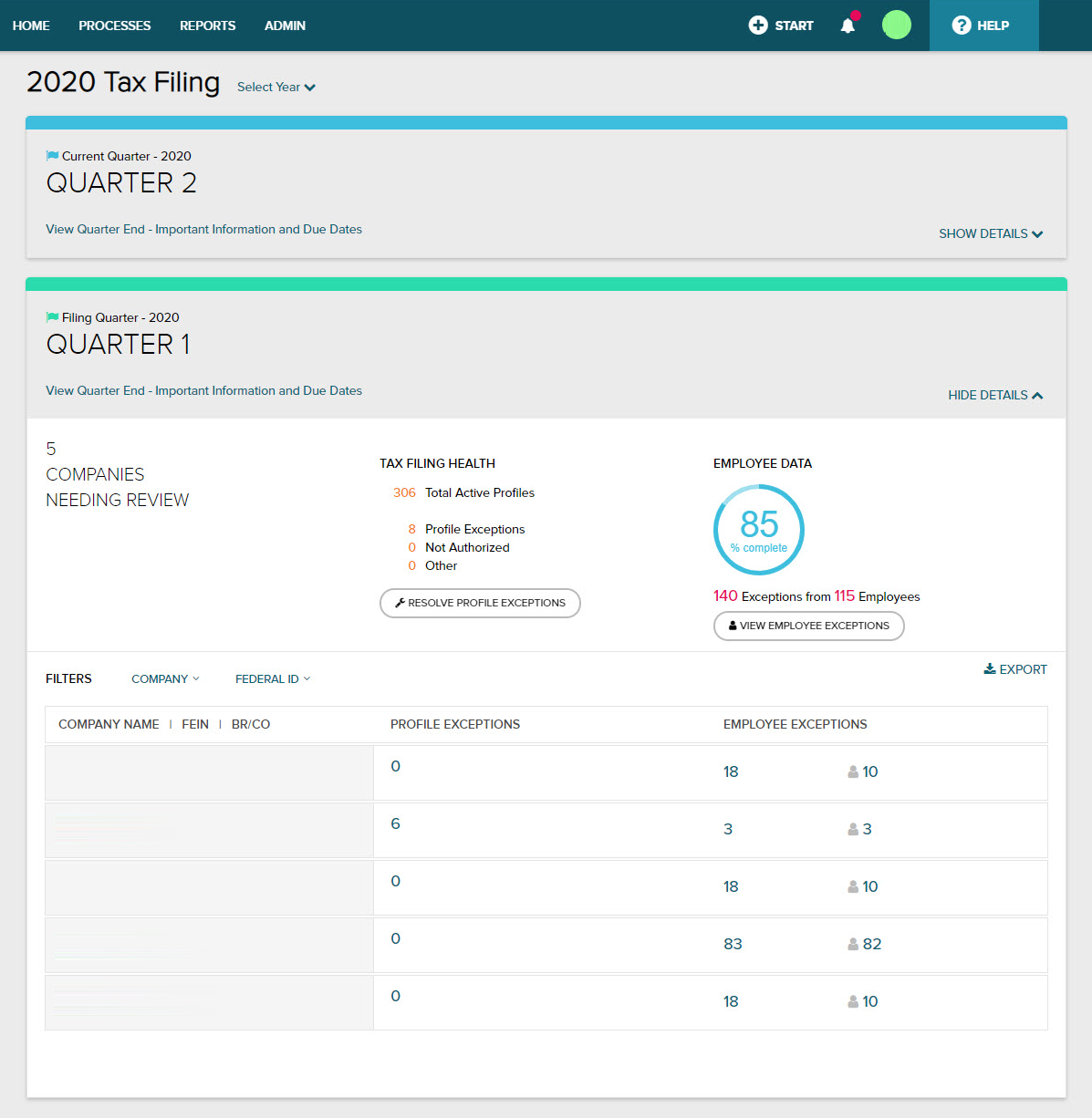

The Tax Filing section has undergone a refresh, now providing you with a more comprehensive grid view of profile and quarter exceptions.

Here’s a peek at what you’ll see:

A new-look display screen will also highlight additional Quarter Profile Exceptions that need to be resolved. To do so, simply click the action icon on the right within SmartCompliance. New quarter exceptions include: State Not Set Up, State Not Active, Local Not Set Up, Local Not Active, ADP Not Authorized to Deposit or File, SUI Rate Missing.

An updated Form 7200 is available: Follow the Covid-19 Updates link at the top of any screen within SmartCompliance, click Report My Credit to ADP and follow the instructions.

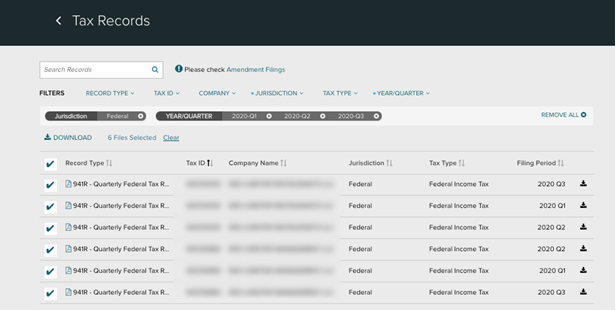

To save time, you can now download up to 50 tax filings in a package, instead of one at a time, and package files into a zip or pdf file format. Simply navigate to Processes>Employment Tax>Tax Records (see below).

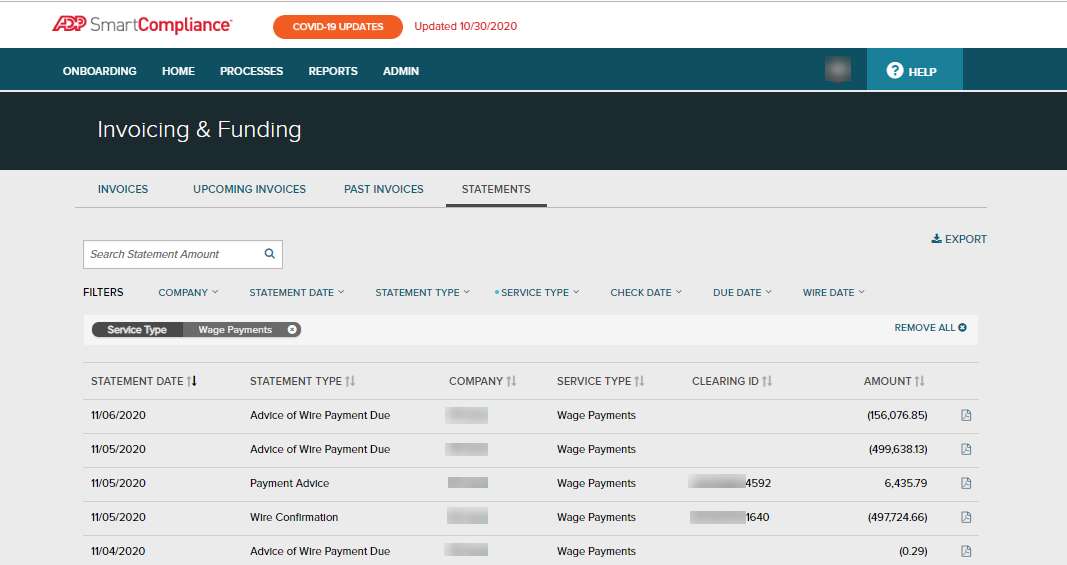

Wage Garnishments or Money Movement (ADPCheck, FSDD or TotalPay) statements are now available via a new statements tab. To find it in SmartCompliance, go to Processes > Invoicing & Funding; where you can view, download, and filter documents by company, statement date, statement type, check date, due date and wire date. You can also search for a specific statement amount for these statements:

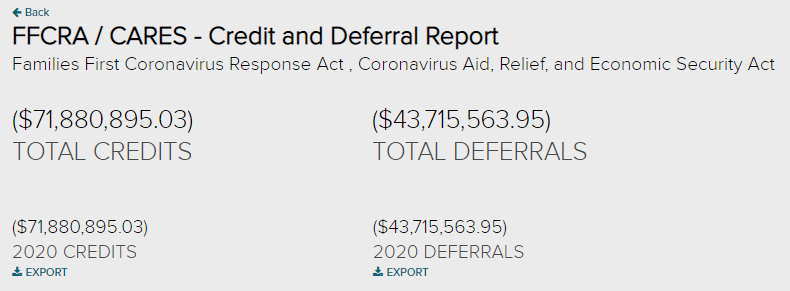

To help you track your FFCRA & CARES Act-related credits, we’ve provided detailed reports that allow you to reconcile these amounts to your own records.

Simply click on the Covid 19 Updates button at the top of the SmartCompliance homepage, then select the View Credit & Deferral Reports option. You’ll find a summary of 2020 credits and deferrals along with the option to export these details into a CSV file.

Here's what you'll see:

If you’ve completed Form 7200 or 5884-C, we’ve made it easier for you to provide us with the related credit amounts you received. It’s easy to do, just click COVID-19 UPDATES, select the relevant link and follow the prompts—we’ll use that data to file your quarterly 941. Quick reminder, the deadline to add these related credit amounts for the second quarter is Thursday, 7/9/2020.

Here’s a look at how to get there:

If you’ve previously elected to defer the federal employer portion of Social Security tax or you’ve elected one or more state-specific deferrals, you can make changes to your end date within ADP SmartCompliance. We’ve added your elections to the Tax Profile experience, where you’ll see your election start and end dates.

If you haven’t elected to defer your federal employer portion of Social Security tax, as allowed by the CARES Act, you can do so here. Just go to Tax Profile and select your federal income tax profile, then follow the prompts…that’s it. Be sure to read the information provided carefully before you make any election.

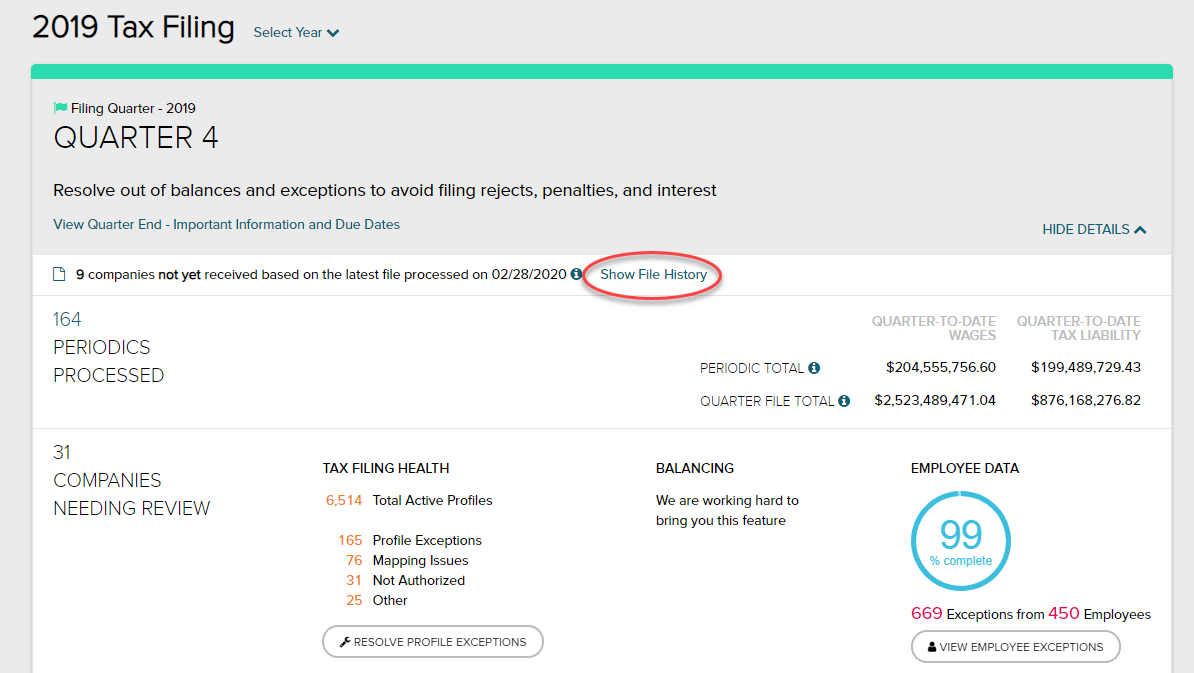

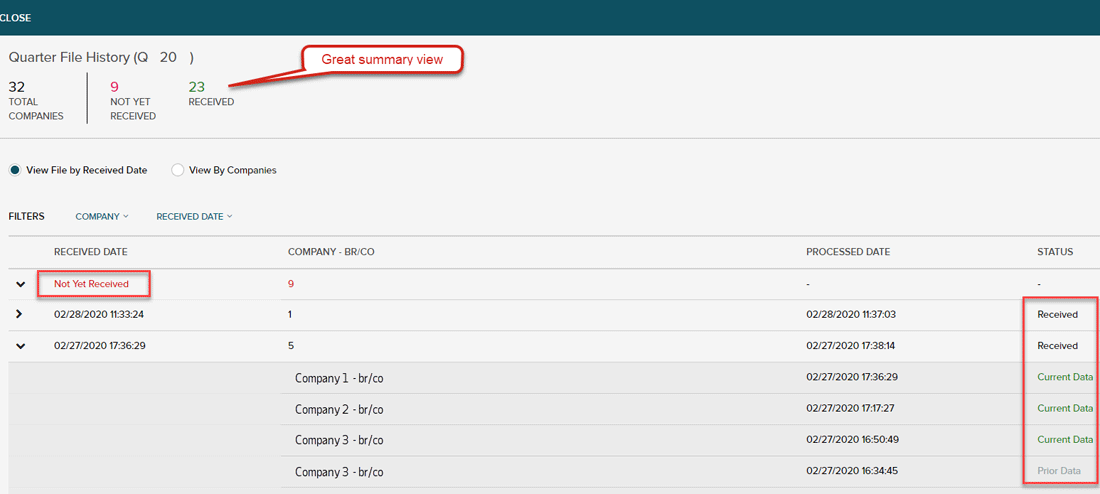

Tax is complicated enough, which is why we’ve made it a whole lot easier for you to check the health of your tax filing data. How is it easier? Let’s dig in.

Now when you log into ADP SmartCompliance and go to Processes > Employment Tax > Tax Filing, you see a whole new experience that consolidates some of the most critical aspects of your tax processing, like error conditions that can wreak havoc on your filings. Here’s what to look for:

Companies Needing Review: This gives you a total count of company codes with exceptions. At a quick glance, you’ll see how many of your company codes require action to help ensure your filings are accurate.

Tax Filing Health: Here you’ll see a total count of active tax profiles and a breakdown of profile exception types and counts. You can see the details and address many of the exceptions noted here by clicking the Resolve Profile Exceptions button

Employee Data: Once your quarter file is processed, you will be able to see a total count of employee exceptions and impacted employees. This is another simplified view designed to help identify employee errors that need to be addressed within your payroll application.

Be sure to go to the Help Center in ADP SmartCompliance for more detailed instructions on any of the features mentioned above. Here’s a quick look at the new space:

To help improve visibility & tracking of open and closed items, your Admins can now view historical Help Requests that have been submitted across your organization. SmartCompliance users who are not administrators will continue to see their own Help Requests as they do today.

If you notified ADP that your company has elected to defer taxes as part of the CARES act, SmartCompliance will display that election and the start and end dates. You can view those dates in the Tax Profile screens.

Just wanted to let you know we’ve added a new state data exchange:

This new data exchange feeds into ADP SmartCompliance and allow us to give you direct visibility and instructions to correct registration issues that may pop up. This can really help reduce e-file rejections, as well as the risk of Penalty and Interest assessments.

If something pops up, we’ll let you know about it in the Tax Profile tile on the home page.

There’s nothing more important to us than making sure your sensitive data is protected at all times. That’s why when we need to send you a document, we will no longer email it to you as an attachment. Instead you’ll receive an email notification with a link, so you can retrieve the file from ADP SmartCompliance®.

We’ve added TPA notification for Iowa State Unemployment Insurance.

If you already have Iowa State Unemployment Insurance set up in ADP SmartCompliance, or when you add it, we’ll let you know if you’re missing the required authorization, what to do to complete it and link you directly to the agency’s website to take care of it.

Just wanted to let you know we’ve added a new state data exchange:

This new data exchange feeds into ADP SmartCompliance and allow us to give you direct visibility and instructions to correct registration issues that may pop up. This can really help reduce e-file rejections, as well as the risk of Penalty and Interest assessments.

If something pops up, we’ll let you know about it in the Tax Profile tile on the home page.

We’ve added TPA notifications for Nevada State Unemployment Insurance.

If you already have Nevada State Unemployment Insurance set up in ADP SmartCompliance, or when you add it, we’ll let you know if you’re missing the required authorization, what to do to complete it and link you directly to the agency’s website to take care of it.

Just wanted to let you know we’ve added some new state data exchanges:

These new data exchanges feed into ADP SmartCompliance and allow us to give you direct visibility and instructions to correct registration issues that may pop up. This can really help reduce e-file rejections, as well as the risk of Penalty and Interest assessments.

If something pops up, we’ll let you know about it in the Tax Profile tile on the home page.

We made some updates to Help to give you you faster, more trackable and more secure access to important resources. Be sure to check these updates out now in ADP SmartCompliance:

You told us you’d like to be able to easily identify requests that have been updated—great news, we’ve done it!

Now, when you open Help, you’ll see little pink dots and pink lines in several places, which let you know where new updates are available for you. These indicators will be visible for requests you’ve submitted, as well as those requests that have been shared with you.

If you haven’t used it yet, Chat is an easy way to quickly connect with an Employment Tax representative and get the answers you need to general questions in a few clicks! It’s super easy to use, just log into ADP SmartCompliance, hit the Help button, then go to Start Chat. Chat is available Monday - Friday, 9 a.m. to 6:30 p.m. ET. We recommend Chrome or Firefox for Chat users while we work on a compatible Internet Explorer solution.

When to Submit a New Request - When you need account-specific help. Submitting requests can help improve response times and trackability. Also, it’s just a better way to help further protect your information

When to use Chat - When you need general question help, like with deadlines (e.g. funding, periodic processing) or processing (e.g. ADP SmartCompliance use).

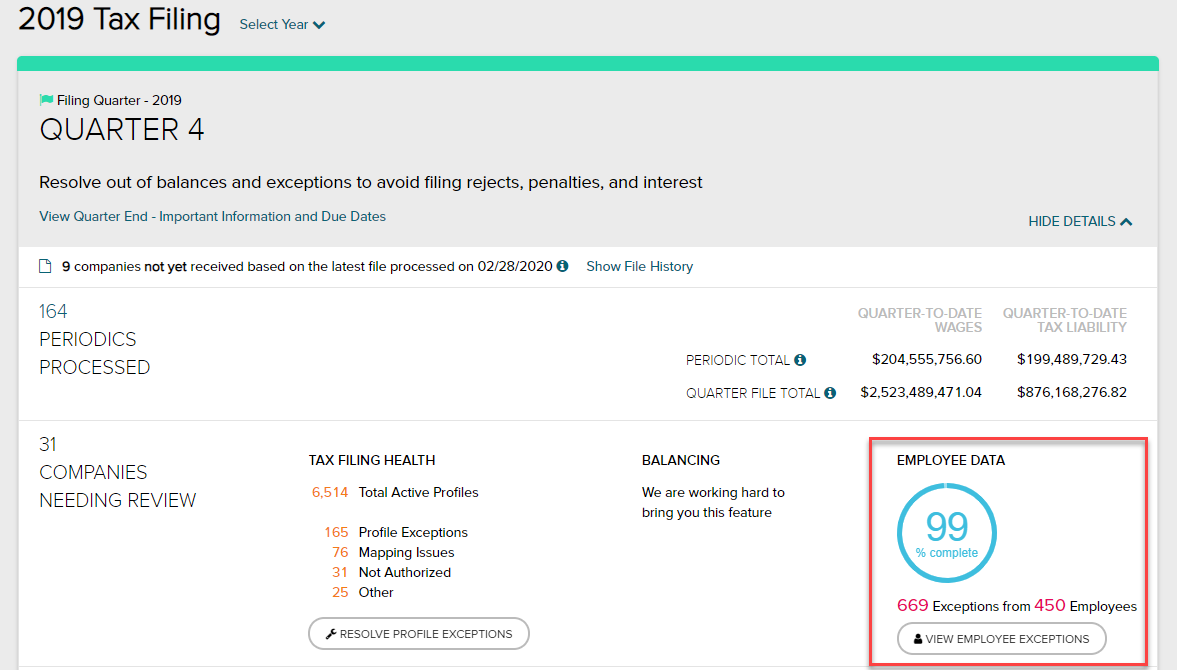

New features on Tax Filing (non-ADP payroll tax) - There have been a couple of additions to the Tax Filing experience on your Employment Tax workspace:

New Quarter Employee Error view –This new view is another step towards a more robust quarter processing experience.

On your tax-filing experience, you’ll see a new EMPLOYEE DATA summary with a great snapshot of your total employees, employee exception volume and the percentage complete status. Also, you can click the View Employee Exception link to review and export the related detail.

We also added new error types to help reduce emails to you, while speeding up your ability to see these in ADP SmartCompliance.

Just wanted to let you know we’ve added some new state data exchanges since November:

These new data exchanges feed into ADP SmartCompliance and allow us to give you direct visibility and instructions to correct registration issues that may pop up. This can really help reduce e-file rejections, as well as the risk of Penalty and Interest assessments.

If something pops up, we’ll let you know about it in the Tax Profile tile on the home page.

If you already have Minnesota State Unemployment Insurance (SUI) set up in ADP SmartCompliance, or when you add it, we’ll let you know if you’re missing the required authorization, what to do to complete it and link you directly to the agency’s website to take care of it.

With this new feature, you no longer need to navigate to the report section to see your profile changes in ADP SmartCompliance. Instead, you can stay in the Tax Profiles workspace and select View History to see your changes. You can also select a variety of filters to narrow your search and export the results.

Several new state data exchanges have been added:

These new data exchanges feed into ADP SmartCompliance and allow us to give you direct visibility and instructions to correct registration issues that may pop up. This can really help reduce e-file rejections, as well as the risk of Penalty and Interest assessments.

If something pops up, we’ll let you know about it in the Tax Profile tile on the home page.

If you already have Minnesota State Unemployment Insurance (SUI) set up in ADP SmartCompliance, or when you add it, we’ll let you know if you’re missing the required authorization, what to do to complete it and link you directly to the agency’s website to take care of it.

| What's New | Why you will love it |

| A new “Tax Filing” button that takes you to a whole new experience | We took multiple tax reconciliation data elements you gather from different locations and reports today and centralized them on one page! |

| Centralized view of periodic and quarter totals | At a glance, you’ll see a dashboard view of your payroll tax and quarter file balance totals. No need to hop around checking various reports to see if you’re out of balance. |

| Easy access to important dates and deadline | The Quarter-End Notes are now at your fingertips and downloadable to PDF. |

| Company-level view of exceptions grouped by resolution needed | Resolve more exceptions with fewer steps. We’ll group errors that can be resolved with one profile update. This can help you resolve exceptions faster and reduce the risk of late filings/deposits and potential penalty and interest. |

| We’ve added filters | You’ll now have the ability to filter your data to see what you want. Just filter what you want, export it, and you’re good to go. |

| Expanded Exception History | Now see what updates have been made, who made them and when they occurred. |

All these enhancements are part of a new experience! Check out this job aid to jump in and get started today.